Sage Intacct 2025 Release 3 introduces enhancements that make financial management smarter, faster, and more efficient. From AI-driven automation to streamlined approvals and expanded AP/AR capabilities, this update is designed to reduce manual work, improve accuracy, and provide greater visibility into your data. These new features empower finance teams to simplify processes, stay compliant, and make confident decisions.

Let’s explore the key highlights of this release and how they can help your organization get more value from Sage Intacct.

AI Automation:

1. Line-level matching for smarter Purchasing automation – Early Adopter

Instead of relying on source transaction data, this feature uses AI/ML to match and populate line items directly from vendor documents that you email or upload. This enhancement helps reduce manual corrections and improves automated transaction draft accuracy by using the vendor document as the source of truth. It flags discrepancies in quantity or price, allowing you to quickly identify and resolve mismatches and reduce time spent on manual edits, improving your confidence in automated transaction processing.

2. Calculate overtime in timesheets automatically in Sage Intelligent Time

You can now apply overtime rules for payroll and project billing. This allows Sage Intelligent Time (SIT) to calculate overtime hours that employees have worked. Create and assign overtime rules to ensure accurate and compliant payroll operations, enhancing overall efficiency. Key benefits of this feature include:

- Improve data accuracy and reduce manual tracking errors.

- Effectively manage and track the work of remote employees.

- Streamline tasks, such as tracking, analyzing, and reporting on employee overtime data.

- Maintain strict compliance with regional labor regulations, reducing legal risks and penalties.

When an employee clocks in and out of a shift, Sage Intelligent Time records their total work hours and calculates any applicable overtime. The hours, including regular and overtime, are displayed on both the employee timesheet and time clock.

3. Smarter email capabilities for AP Automation and AP Automation with Purchasing

A new email domain will provide an enhanced email experience, including by supporting auto-forwarding rules, inline attachments, and email body extraction.

With smarter email capabilities, you’ll get the following benefits:

- Auto-forwarding rules: Save time with auto-forwarding rules, so you do not have to forward each email to your automation email manually.

- Inline attachments: Attachments that are in the email body are now extracted for processing.

- Text from email body: Transactions can now be read even when they’re in the email body as text, not just when added as an attachment.

- iPhone image support: We now support iPhone images in the HEIC file format for incoming attachments. This format is not supported for split view, but you can download the attachment to compare transaction details.

After you’re on the new email address domain, your email addresses change from @sagemail.com to @ai.sage.com.

All companies that subscribe to AP Automation after May 2025 are automatically set up on this new email option. There are no additional steps that you need to take. Your email address domain is @ai.sage.com.

In November 2025, all companies will move automatically to the new email domain for AP Automation. Get a head start by taking advantage of the smart email capabilities now.

4. Automate transactions without matching for AP Automation with Purchasing – General availability

You can now automate transactions that do not have a source match defined (such as vendor invoices that do not start with purchase requisitions or orders), boosting efficiency by combining AI-powered transactions with the flexibility of the Purchasing application.

With this update, you can do the following

- Configure transaction definitions to automate transactions that do not have a previous transaction to match with in the purchasing workflow.

- Change the transaction type for incorrect predictions, which feeds back to the machine learning model to improve future predictions.

- Get the benefits of both automated transaction matching and non-matching transactions. You have the flexibility to set up both options or use just one, whichever meets your needs.

Accounts Payable Enhancements:

1. Delegate bill approvals when an approver is out of office

You can now maintain uninterrupted bill approvals when an approver is unavailable with approval delegation. Whether due to vacation, leave, or other absences, delays can be avoided with bill approval delegation ensuring that bills continue to move through the approval workflow.

Key benefits

- Maintains seamless bill approval workflows during the planned or unplanned absence of an approver.

- Eliminates delays and the need for manual intervention in the approval process.

- Allows delegation to both individuals and user groups, for flexible coverage.

- Supports compliance and accountability with audit trails and delegation logs.

- Provides visibility into delegation activity through custom reporting tools.

- Allows configuration through both the user interface and the API.

2. Vendor Payments powered by MineralTree – General availability

Introducing a new way to manage vendor payments directly within Sage Intacct through a seamless integration with MineralTree. This new payment service supports all your entities in Sage Intacct, along with your bill workflows and payment approvals. If you use AP Automation, you can add Vendor Payments to your existing automated transaction and approval workflows for a complete end-to-end automation solution.

Vendor Payments powered by MineralTree allows you to do the following

- Seamlessly pay vendors with ACH, virtual card, or check directly within Sage Intacct from your existing bank accounts.

- Maintain vendor payment preferences and automatically send detailed remittances.

- Direct debit funding for faster payments and simpler bank reconciliations compared to solutions that require settlement accounts.

- Earn cash-back rebates on virtual card spending.

3. Pay bills from the Vendors list

Pay a vendor directly from the Vendors list without interrupting your workflow, using the Pay option.

The Pay option appears for each vendor in the Vendors list when you have the appropriate permissions to pay bills. When you select Pay for a vendor, a Pay bills window appears, showing the vendor’s open bills.

This reduces the number of steps required to make payments to a single vendor and improves efficiency for Accounts Payable clerks who manage transactions by vendor.

Accounts Receivable Enhancements:

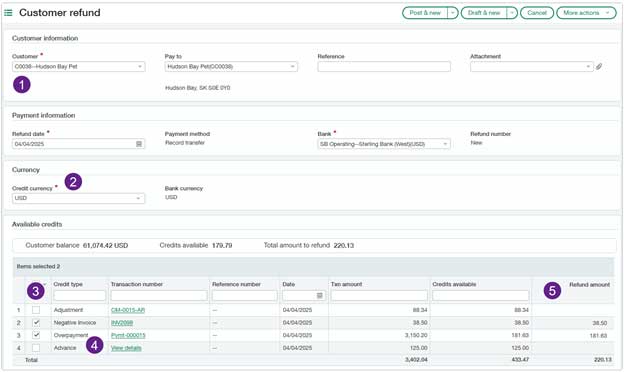

1. Record customer refunds – General availability

The ability to record customer refunds is now generally available to all customers.

Customer refunds streamline your refund management process, ensuring that the refunds that you initiate outside of Sage Intacct are accurately documented and the refunded credits are cleared. Eliminate the tedious step of creating balancing adjustments for refunded credits. Instead, record the amount refunded and pay available credits simply by selecting them.

On the new Customer refunds page, record a refund using the record transfer payment method. Enter the amount you refunded and match it to the customer’s available credits. Select from the customer’s available advances, adjustments, overpayments, or negative invoices, applying amounts partially or in full.

Upon posting, Sage Intacct automatically clears the selected credits, keeping the customer account up-to-date.

- Select the Customer to view credits available to refund.

- Select a Credit currency to show credits with the same transaction currency.

- For customers with many credits available, sort and filter columns to find the credits you want to refund.

- Available credits show customer advances, adjustments, overpayments, or negative invoices that have a remaining balance.

- For each credit, Intacct shows the credit type, transaction amount, and credits available. Drill down into the transaction for more details.

- You can refund a partial amount by overriding the Amount to refund for the selected credit.

Review and manage both draft and posted refunds on the Customer refunds list. Drill down into refund details and from there into the credits that were refunded.

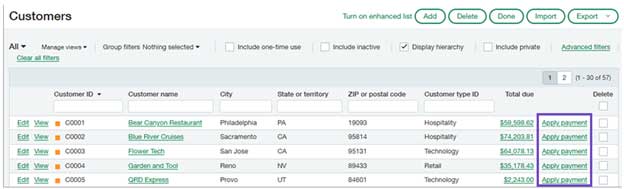

2. Apply payments from the Customers list

Receive customer payments while on the Customers list without interrupting your workflow, using the Apply payment option.

The Apply payment option appears for each customer in the Customers list when you have the appropriate permissions to manage payments. When you select Apply payment for a customer, a Receive payments popup window opens, showing the customer’s open invoices.

This reduces the number of steps required to receive payment from a single customer and improves efficiency for Accounts Receivable clerks who manage transactions by customer.

3. Enhancements to how you apply credits

A new set of enhancements is designed to streamline how you apply credits when receiving a payment. These updates are designed to reduce clicks, simplify workflows, and improve overall usability.

Apply Credits when receiving payments

A new Apply credits button is added to Receive payments. You can use it to select credits that you want Intacct to distribute across your selected invoices using the waterfall method.

- Apply credits is available when you receive a payment from a single customer.

- The total credits that you select must not exceed the sum amount of the selected invoices.

- You can override the credit distribution amounts before you post.

- You can receive payment for any amount up to the total invoice amount minus the value of the selected credits.

- If you prefer to control which credit is applied to which invoice, you can apply credits by selecting them for each invoice individually, as before. Choose the method that works best for your workflow.

Apply multiple adjustments to invoices from the AR adjustments list

Apply multiple adjustments for a customer simply by selecting the transactions in the AR adjustments list. You can even receive payment at the same time that you apply the credits, without leaving the AR adjustments list.

- Selected credits must be for the same customer and use the same currency.

- When you select multiple invoices, credits are applied to the invoices using the waterfall method.

- You can override the credit distribution amounts before you post.

- You can receive payment for any amount up to the total invoice amount minus the value of the selected credits.

- The selection box appears only for Posted and Partially paid adjustments.

4. Enhancements to customer advances

Customer advances have improved with tracking for payment IDs, flexibility with draft advances, and by making it easier to receive a payment while applying an advance.

Payment IDs for customer advances

Assign a document sequence to customer advances to automatically generate a unique Payment ID when the advance is posted. This ID appears in standard views and reports, improving traceability. Intacct shows the Payment ID in standard views of the Advances list and on the detail page for posted advances. Payment IDs are also included in the AR Ledger, Customer aging, Receipts register, and in custom reports.

Applying an advance and receiving payment from the list

To make your workflow more efficient, the Apply more is an enhanced option on AR advances that allow you to do the following:

- Apply the advance to multiple invoices

- Receive payment on the remaining invoice balance

How it works:

- On the AR advances list, select Apply more for the advance.

- Select and add the invoices that you want to apply the advance to.

- Intacct opens the Receive payments page, where you can see that the system automatically distributed the advance between the two invoices.

- Under Payment information, enter the Amount received from the customer, and then select Post.

The invoices are paid in their entirety, and the advance is fully applied.

5. Retiring customer payment service integrations this year

Customer payment service integrations with Authorize.net and PayPal are retiring on November 7, 2025. This means that customer payment services and APIs for customer bank and credit card accounts will no longer be supported to process payments after this time.

Cash Management Enhancements

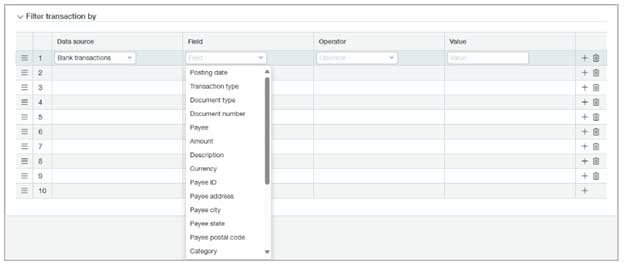

1. Improve bank transaction matching with more precise rules

You can now use even more fields from incoming bank transactions to tailor your matching and creation rules or assignment rules. Use the wider range of fields to increase matching accuracy during reconciliations and when automatically assigning customers to bank transactions.

In addition, when viewing bank transactions or creating new views, select from the expanded range of fields to customize how you view bank transaction lists.

Matching rule filtering:

Bank transaction view:

2. New NACHA payment file formats

Save time and pay vendors and employees electronically in Sage Intacct with new bank file formats. We now support NACHA bank payment files that include the ID numbers for vendors and employees being paid.

New file formats include:

- NACHA – Balanced without EOF marker incl ID number

- NACHA – Balanced with EOF marker incl ID number

- NACHA – Unbalanced with EOF marker incl ID number

- NACHA – Unbalanced without EOF marker incl ID number

3. Funds transfers at entity level now require at least one bank account from that entity

When you add a funds transfer at the entity level, Intacct now checks that at least one of the accounts is owned by the entity. If neither account belongs to the entity, Intacct displays a message to inform you and does not post the transaction.

Automate equity method with Advanced Ownership Consolidation – Early Adopter

Advanced Ownership Consolidation now supports the equity consolidation method in ownership structures. The Sage Intacct equity consolidation method automatically records a subsidiary’s ownership net income to the parent entity or entities based on ownership percentage.

Sage Intacct’s equity consolidation method does the following:

- Automates the recording of subsidiary income to a user-defined book for the parent entity or entities.

- Ensures ownership transparency by recording and tracking changes by period.

- Supports single subsidiary rollup to multiple parents with multiple rollup levels.

The equity consolidation method provides the following key benefits:

- Ownership structures reflect a more comprehensive view of percentage ownership of entities, enabling the recording and tracking of changes by accounting period.

- Subsidiary entities roll up to multiple parent entities, up to 10% ownership, with inclusion in multiple rollup levels.

- Leverages the new affiliate entity dimension to auto-tag new equity consolidation entries on parent entities, driving greater flexibility and accuracy in financial reporting.

Contracts Enhancements

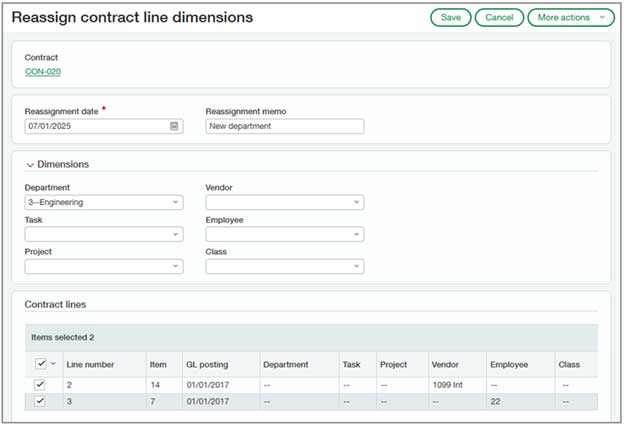

1. Reassign dimensions on contract lines

The ability to change dimensions on in-progress contract lines as of a specified date without affecting past transactions has been added.

This enhancement supports more accurate financial reporting, helps align contract data with evolving business structures, and gives you greater flexibility.

Previously, after a contract line had posted transactions, its dimensions were locked. This made it difficult to correct mistakes or update dimensions for new reporting needs.

Now, for in-progress contracts with posted transactions, you can modify the following dimensions:

- Class

- Department

- Employee

- Project (if no billed or recognized project-related transactions)

- Task (if not billed or recognized task-related transactions)

- Vendor

Dimension changes only apply to unbilled deferred revenue and unbilled sales revenue transactions going forward, as of the reassignment date.

All reassignment actions are captured in the audit trail for full transparency.

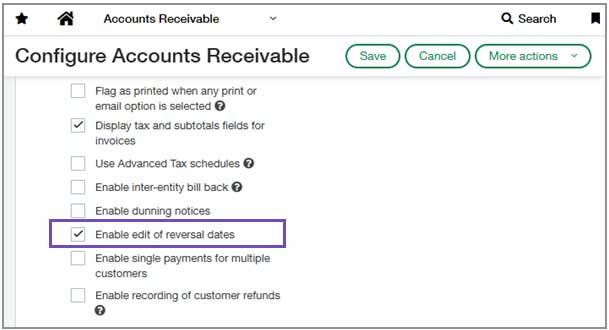

2. Edit reversal dates on AR payments

Contracts users can now edit the reversal date on AR payments. With this update, you can correct reversal dates, improving accuracy and streamlining the AR workflow while maintaining consistency between AR and Contracts.

The Enable edit of reversal dates setting is now available in Accounts Receivable Configuration for Contracts users.

After enabling it, you can edit the reversal date on posted payment reversal transactions from the Posted Payments list. If an associated invoice was created from a contract, Intacct reclasses the contract and updates its Transaction History to reflect the new reversal date.

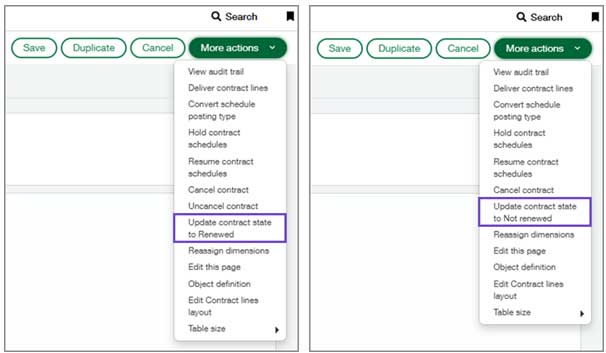

3. Update contract states to Renewed or Not renewed

New actions are added to help you update contracts that need to be transitioned to Renewed or Not renewed. These actions give you more control and help keep your contract data accurate and up to date.

When editing an in-progress contract that needs a state update, you’ll now see one of the following actions in the More actions menu:

- Update contract state to Renewed

- Update contract state to Not renewed

These actions also update the contract line states. After the update is complete, the action is no longer available in the menu.

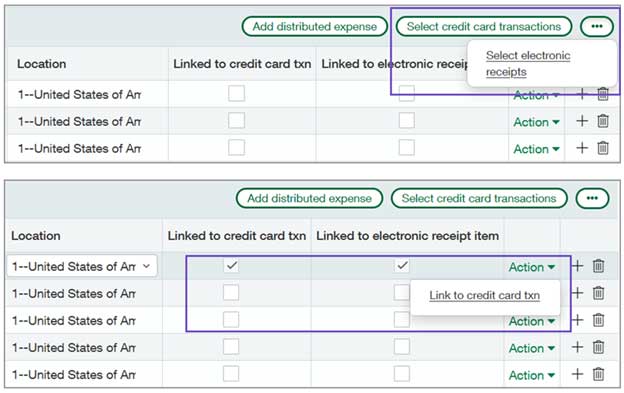

Link credit card transactions and electronic receipts to employee expense reports

You can now use credit card transactions and electronic receipts together in employee expense reports to enter data quickly. Link credit card transactions with electronic receipts to help automate your employee expense creation process, saving time and reducing manual effort.

Key benefits

- Create credit card transactions automatically: Set up a Cash Management creation rule to generate credit card transactions automatically from bank feeds or bank transaction import files. Then, you can add credit card transactions linked with receipt images to expense reports.

- Link all documents to an expense line: Match receipts and credit card transactions at line level. This ensures accurate data representation, enhancing visibility during the approval process.

- Split credit card transactions: For added flexibility, you can split a single credit card transaction into multiple expense lines on an expense report. Then, you link the credit card transaction to a receipt.

Previously, you could only use credit card transactions and electronic receipts separately. With the release, you can use credit card transactions and electronic receipts together in expense reports for a more streamlined workflow.

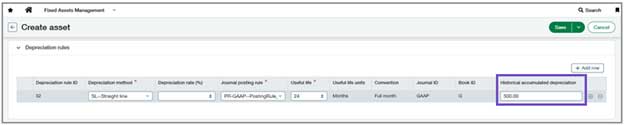

Fixed Assets Management

1. Provide your own accumulated depreciation for historical assets

You can now provide a custom historical accumulated depreciation amount when importing or creating historical assets. Historical assets are assets that started to depreciate in a different accounting system, before moving to Fixed Assets Management.

This added flexibility makes it easier to migrate to Fixed Assets Management while maintaining consistency with your organization’s existing records.

2. Update assets in bulk using the import service

You can now update assets in bulk using the import service, saving time and reducing manual effort. This enhancement lets you perform the following actions for multiple assets at once:

- Place assets in service

- Dispose of assets

- Transfer assets

- Place assets back in review

- Place assets back in service

- Update asset details

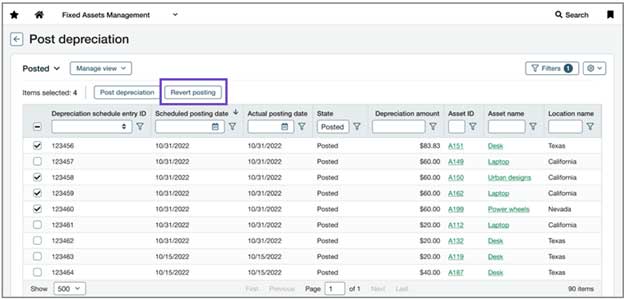

3. Revert posted depreciation entries in bulk

You can now revert multiple depreciation postings at once from the Post Depreciation page. For example, if you post depreciation accidentally or want to place an asset back in review, you can quickly undo all the postings, saving time and reducing manual effort.

4. Depreciation enhancements

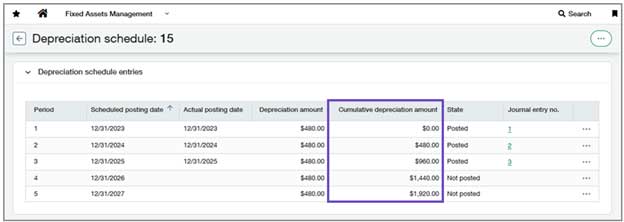

The ability to view cumulative depreciation and update the daily depreciation method has been added.

A new column is added to depreciation schedules called Cumulative depreciation amount, which shows a running total of accumulated depreciation. This added visibility helps users track depreciation at a glance and reduces the need for manual calculations. You can also add the Cumulative depreciation amount field to the Post Depreciation list and in custom reports.

General Ledger Enhancements

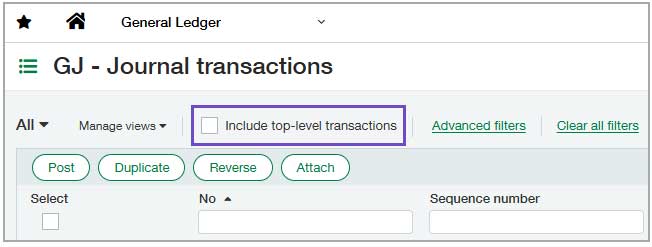

1. View top-level journal entries at the entity level

To accelerate the load time for transactions on the Journal Transactions list page, use additional the Include top-level transactions checkbox. You’ll see this checkbox only when working at the entity level.

The checkbox is cleared by default, so the top-level transactions are initially filtered out of the list at the entity level.

2. Deactivate alternative AP and AR accounts

You can now prevent accidental postings by deactivating alternative Accounts Payable and Accounts Receivable accounts that you no longer use. This applies even if the account has been used in a transaction or is the default account for a customer or vendor.

Previously, you received an error when deactivating an alternative account.

When you deactivate an alternative account, it no longer appears in the list of AP or AR accounts on the Bill, AP Adjustment, and Invoice pages. Therefore, the account can no longer be used in these transactions.

You can deactivate alternative accounts even if existing unpaid bills or open invoices were posted to the account. But you’ll need to reactivate the account before posting transactions against the bills or invoices.

You still cannot deactivate an account if it’s used as the default GL account on the Configure Accounts Payable or Configure Accounts Receivable page. Select a different GL account on the configuration page before deactivating the alternative account.

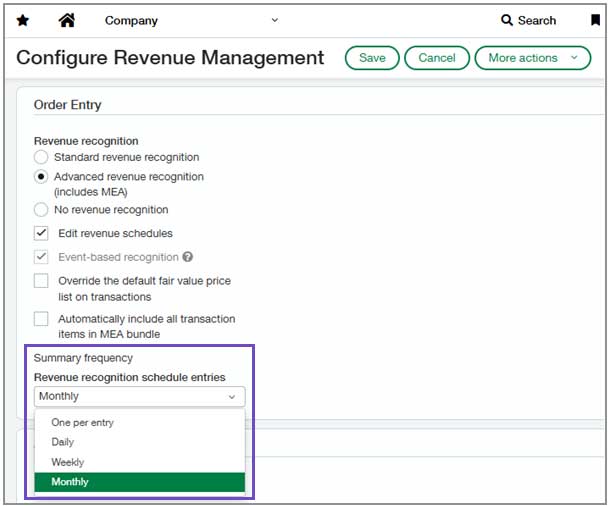

Summarize OE revenue recognition entries

1. Summarize revenue recognition postings to the General Ledger on a daily, weekly, or monthly basis.

This new capability reduces posting volume, improves performance, and makes reconciliation and audit processes faster and easier.

A new Summary frequency setting in Revenue Management lets you define how entries are grouped when posted to the GL. You can choose between daily, weekly, monthly, or one-per-entry summarization. Entries with the same document type, currency, and location will be combined into a single journal entry based on GL posting date and your chosen frequency.

The default option, One per entry, maintains the previous behavior and creates a separate journal entry for each revenue recognition entry.

2. New summary frequency column in Order Entry

A new column in the Documents configuration tab of Order Entry configuration has also been added. It shows the summary frequency for transaction definitions that post revenue. This column reflects the setting you defined in Revenue Management configuration.

3. New revenue summaries list in Order Entry

Review all summarized revenue entries with the new Revenue Summaries list in Order Entry. This list includes posting dates, amounts, and links to the corresponding journal entries.

Improved revenue recognition based on budgeted project cost

The way the percent complete revenue recognition is calculated when recognition is based on a project’s budget vs. actual costs has been improved. You can now calculate revenue as of a desired date and Intacct will include all applicable GL transactions that post on or before that date.

This ensures that revenue is recognized using only the applicable actual costs posted within the same reporting period, improves financial accuracy and auditability by eliminating cost blending across periods, and reduces timing-related discrepancies in revenue recognition due to late cost transaction postings.

An Update percent complete schedules button has been added to the Manage revenue schedules page. This gives you control over your month-end close process over when project revenue is calculated and scheduled.

The scheduled posting date for revenue schedules based on a project’s budgeted vs. actual costs will remain blank until you execute the Update percent complete schedules process. So, you are now required to execute this process prior to posting this type of project revenue.

Purchasing Changes

1. New way to combine multiple documents into a single transaction

You can now simplify your workflow during conversion by combining multiple documents, or specific line items, into one transaction. For example, when a vendor sends you an invoice for multiple orders, you can create a single Purchasing transaction from multiple converted documents, including specific line items. Now you can choose to convert one or more documents at one time, including specific lines of documents.

2. Line-level matching for smarter Purchasing automation – Early Adopter

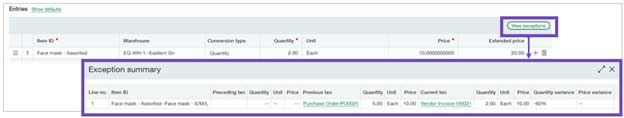

Line-level matching introduces a more precise way to automate transaction processing with AP Automation with Purchasing. Instead of relying on source transaction data, this feature uses AI/ML to match and populate line items directly from vendor documents that you email or upload. This enhancement helps reduce manual corrections and improves automated transaction draft accuracy.

Line-level matching increases the accuracy of transaction data by using the vendor document as the source of truth. It flags discrepancies in quantity or price, allowing you to quickly identify and resolve mismatches. This reduces the time spent on manual edits and improves confidence in automated transaction processing.

3. Announcing Sage Intacct eProcurement

Gain real-time access to product information and pricing, improve spend management by capturing negotiated discounts, and ensure compliance with procurement policies.

Key benefits

- Increased efficiency and time savings: Punchout catalogs enable you to create shopping carts directly from a vendor’s website. Transaction data is then seamlessly transmitted to Sage Intacct, eliminating the need for manual order entry.

- Real-time data access: Gain immediate access to current product information, pricing, and availability directly from suppliers.

- Optimized spend management: Effectively manage expenditures by capturing and utilizing negotiated discounts.

- Compliance assurance: Ensure adherence to procurement policies by integrating your guidelines into the vendor’s web portal shopping experience.

4. Gain clear visibility into match tolerance exceptions

In 2023 R3 match tolerance exception tracking is enabled on draft documents. You can now view a more complete history of tolerance exceptions, ensuring that you can more accurately track and resolve mismatches.

Help content enhancements

Introducing two new enhancements to improve your Sage Intacct content experience:

- User interface content toggle

- Language switcher

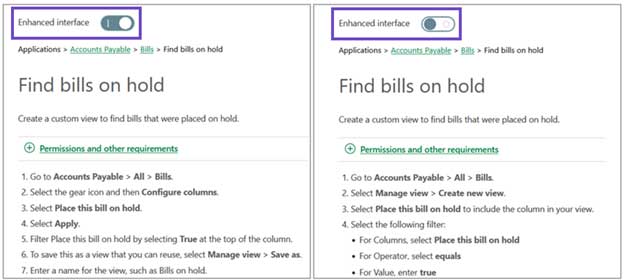

User interface content toggle

You’ll now find a handy toggle on relevant online help pages. This lets you easily switch between instructions for our existing interface and the new, enhanced one. So, no matter which version you’re using, you can quickly find the how-to information you need.

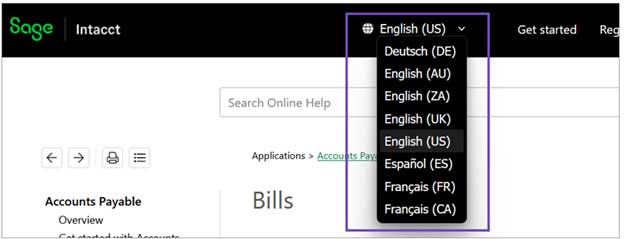

Language switcher

A language switcher is added to the top of the help content and release notes, making it easier to view documentation in your preferred language. Selecting a language will load the corresponding translated version of the current page.

Unlock the Full Potential of Sage Intacct 2025 R3

Ready to take advantage of the powerful new features in Sage Intacct 2025 Release 3?

At CBIZ, our experts are here to help you explore what’s new, align these enhancements with your unique goals, and implement them seamlessly. We’re committed to helping you maximize every update – empowering smarter, data-driven decisions with confidence.

Contact us today to learn how CBIZ can support your team with Sage Intacct’s latest capabilities.

© Copyright CBIZ, Inc. All rights reserved. Use of the material contained herein without the express written consent of the firms is prohibited by law. This publication is distributed with the understanding that CBIZ is not rendering legal, accounting or other professional advice. The reader is advised to contact a tax professional prior to taking any action based upon this information. CBIZ assumes no liability whatsoever in connection with the use of this information and assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein. Material contained in this publication is informational and promotional in nature and not intended to be specific financial, tax or consulting advice. Readers are advised to seek professional consultation regarding circumstances affecting their organization.

“CBIZ” is the brand name under which CBIZ CPAs P.C. and CBIZ, Inc. and its subsidiaries, including CBIZ Advisors, LLC, provide professional services. CBIZ CPAs P.C. and CBIZ, Inc. (and its subsidiaries) practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. CBIZ CPAs P.C. is a licensed independent CPA firm that provides attest services to its clients. CBIZ, Inc. and its subsidiary entities provide tax, advisory, and consulting services to their clients. CBIZ, Inc. and its subsidiary entities are not licensed CPA firms and, therefore, cannot provide attest services.