Income Approach Overview

Pursuant to valuation theory, there are three main valuation approaches: the income approach, the cost approach and the market approach. The income approach is a general way of determining a value indication of a business, business ownership interest, security, or asset using one or more methods that convert anticipated economic benefits into value. Thus, under the income approach, value is measured as the present worth of anticipated future net cash flows generated by the business, security, or asset.

The two primary valuation methods under the income approach are the direct capitalization (“DC”) method and the discounted cash flow (“DCF”) method. The DC method requires that the historical benefits measure be normalized and that expected future benefits trends be stable or exhibit constant growth characteristics. The DCF method also requires that historical benefits be normalized; however, it allows for variable expected future benefits trends, which can result from variations in revenue growth, changes in a company’s product mix and/or production methods, changes in depreciation, debt repayments, effects of cyclical trends, economies of scale, and/or expected periods of supernormal growth.

Under the DC method, a stabilized one-year cash flow is projected, which is then divided by an appropriate capitalization rate (estimated as the difference between the required rate of return on cash flows and the expected long-term growth rate of these cash flows), to arrive at an estimate of value. Under the DCF method, the near-term variable cash flows are discretely projected, after which a stabilized “terminal” cash flow is estimated. The terminal cash flow is converted to terminal value (i.e. value beyond the discrete projection period) using a capitalization rate, similar to the DC method. Finally, the projected discrete cash flows and the terminal value are present valued, using the required rate of return on cash flows, to arrive at an estimate of value.

Comparison of the DC and DCF Methods

Based on the preceding arguments, a valuation practitioner can utilize the DC method if forward-looking projections are not available and the business is expected to experience nominal growth and stable cash flow into the future, while the DCF method can be applied if the growth in cash flows is projected to fluctuate in the near future before stabilizing at its expected long-term growth rate. However, in practice, even if the cash flow growth rate is expected to stabilize immediately, the DCF method can still be utilized by assuming that the long-term growth rate is expected to persist throughout the discrete projection period and the terminal period.

So, a natural question comes to mind: Will the concluded value be the same under a DC method and a DCF method with the same assumptions (i.e. the two methods utilize the same projections, discount/capitalization rate and stable long-term growth rate)? In short, the answer is “yes.” However, special attention needs to be paid to how the capitalization rate under the DC method, and the discount periods under the DCF method, are derived, to ensure consistent theoretical treatment.

Capitalization Rate Adjustment

Intuitively, the projected annual cash flows under the DCF method should be present valued using consecutive one-year discount periods. However, in valuation practice, this is typically not the case due to the following two factors:

- The effective date of the valuation analysis often does not coincide with the beginning date of the projected period; therefore, the remaining term until the end of the first projection period is less than one year.

- A discount period of one year assumes that all cash flow is received at the end of the year, while cash flow is actually generated throughout the year, warranting for a shorter discount period to account for true risk.

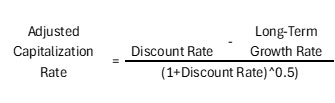

To address the latter argument, valuation professionals use the “mid-period convention” adjustment in DCF analyses, pursuant to which the projected annual cash flows are not discounted for a full 1.0-year period, but are instead discounted for 0.5 years, to account for the continuous cash flow generation throughout the year. When the DC method is utilized, the mid-year convention adjustment to discount periods cannot be applied because under this methodology the cash flow estimate in only one period is capitalized. However, what could be done instead is to adjust the capitalization rate to account for mid-period discounting. The formula that is used to adjust the capitalization rate for mid-period discounting is the following:

Where,

Discount Rate = the estimated required rate of return on cash flows

Long-Term Growth Rate = the expected long-term cash flow growth rate

In the preceding calculation, the difference between the estimated Discount Rate and the Long-Term Growth Rate indicates the Capitalization Rate before the adjustment for mid-period discounting, and the denominator of [(1 + Discount Rate)^0.5] indicates the mid-period discounting adjustment.

Summary

As stated, the estimation of discount periods and capitalization rates needs to be applied consistently between DCF and DC analyses. If a valuation practitioner uses mid-period discounting when applying the DCF method, he/she must adjust the capitalization rate when applying the DC method, and vice versa, if end-of-period discounting is used in the DCF analysis, no adjustment needs to be applied to the capitalization rate in the DC analysis. However, given that for most businesses cash flow is generated throughout the year, using mid-period discounting under the DCF method and adjusting the capitalization rate under the DC method is considered theoretically more appropriate, because it reflects actual business dynamics and aligns the results from DC and DCF analyses with similar inputs and assumptions.

© Copyright CBIZ, Inc. All rights reserved. Use of the material contained herein without the express written consent of the firms is prohibited by law. This publication is distributed with the understanding that CBIZ is not rendering legal, accounting or other professional advice. The reader is advised to contact a tax professional prior to taking any action based upon this information. CBIZ assumes no liability whatsoever in connection with the use of this information and assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein. Material contained in this publication is informational and promotional in nature and not intended to be specific financial, tax or consulting advice. Readers are advised to seek professional consultation regarding circumstances affecting their organization.

“CBIZ” is the brand name under which CBIZ CPAs P.C. and CBIZ, Inc. and its subsidiaries, including CBIZ Advisors, LLC, provide professional services. CBIZ CPAs P.C. and CBIZ, Inc. (and its subsidiaries) practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. CBIZ CPAs P.C. is a licensed independent CPA firm that provides attest services to its clients. CBIZ, Inc. and its subsidiary entities provide tax, advisory, and consulting services to their clients. CBIZ, Inc. and its subsidiary entities are not licensed CPA firms and, therefore, cannot provide attest services.