“How much I make is none of your business!” This is a phrase valuation experts sometimes hear, particularly when gathering information in contentious domestic relations matters. Some business owners feel that a valuation expert is crossing a line when they ask how much they make (and how much they would pay someone else to do their job). The typical business owner’s response — “You’re being too nosy. You don’t need to know how much I make to determine how much my business is worth” — is not unreasonable. Although we live in a society where we broadcast loads of information about ourselves to the public (via Facebook, LinkedIn, Twitter, etc.), our compensation is one of the last pieces of personal information that is still closely guarded. Most people do not realize, however, that adjustments related to owners’ compensation often play a significant role in determining an appropriate value for ownership interests in privately held companies.

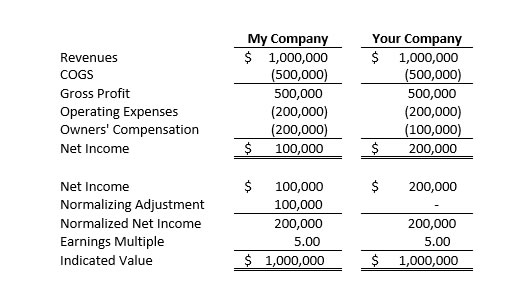

Say you and I run identical businesses (with the same historical and projected operational activity), but you took out $100,000 in annual compensation while I took out $200,000. Whose business is worth more? The answer is they have the same value. See below for the proof:

In many valuations, the analyst must make normalizing adjustments for certain items to better reflect economic reality. One of these adjustments is typically for owners’ compensation. While $100,000 may be the fair market value for the services each of us provided, I may have chosen to pay myself an additional $100,000 since I have control over how my company’s funds are used. This does not make my business any less valuable than yours; it simply means I am paying myself more in compensation rather than directing funds to myself through a dividend/distribution from the company.

When a valuation expert is probing about a business owner’s compensation and how much they would pay a third party to perform their job, it is because this information, in conjunction with information about owners’ compensation for similar companies/positions, allows the valuation expert to arrive at a reasonable normalizing adjustment for owners’ compensation (if one is necessary at all).

For anyone hesitant to provide a valuation analyst with their compensation information, remember we are bound by our professional standards not to communicate that information to anyone outside of the engagement. It can be a critical piece in the valuation puzzle. We are not trying to be nosy. We are simply trying to gather all of the information necessary to reach a supportable conclusion of value.

© Copyright CBIZ, Inc. All rights reserved. Use of the material contained herein without the express written consent of the firms is prohibited by law. This publication is distributed with the understanding that CBIZ is not rendering legal, accounting or other professional advice. The reader is advised to contact a tax professional prior to taking any action based upon this information. CBIZ assumes no liability whatsoever in connection with the use of this information and assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein. Material contained in this publication is informational and promotional in nature and not intended to be specific financial, tax or consulting advice. Readers are advised to seek professional consultation regarding circumstances affecting their organization.

“CBIZ” is the brand name under which CBIZ CPAs P.C. and CBIZ, Inc. and its subsidiaries, including CBIZ Advisors, LLC, provide professional services. CBIZ CPAs P.C. and CBIZ, Inc. (and its subsidiaries) practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. CBIZ CPAs P.C. is a licensed independent CPA firm that provides attest services to its clients. CBIZ, Inc. and its subsidiary entities provide tax, advisory, and consulting services to their clients. CBIZ, Inc. and its subsidiary entities are not licensed CPA firms and, therefore, cannot provide attest services.