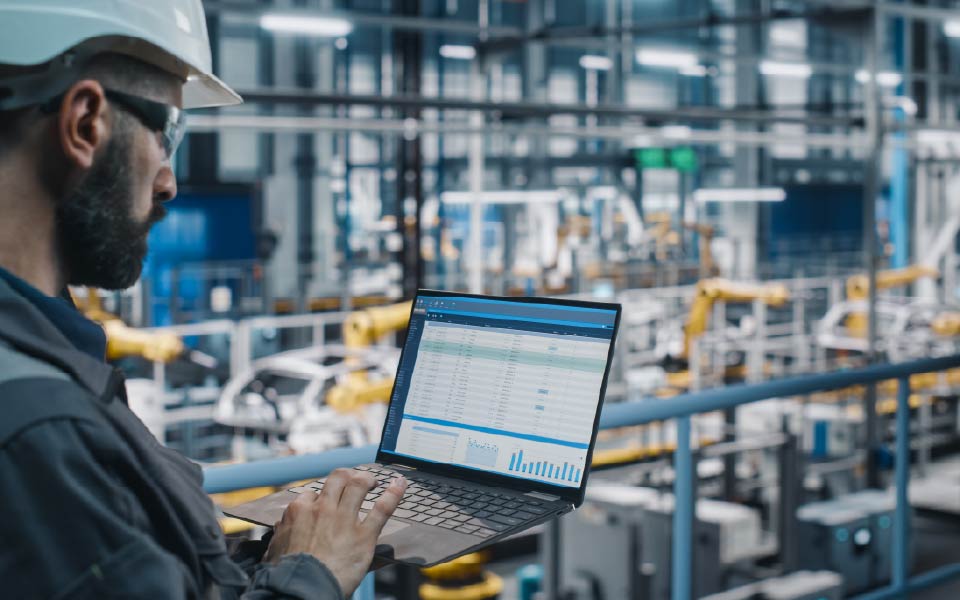

For businesses depending on third-party suppliers for key business operations, a disruption in one part of the supply chain can have devastating effects. Whether it’s due to a cyberattack, natural disaster, or global trade policies and tariffs, a supply chain crisis has the potential to stall production, impact revenue, and damage your brand.

To mitigate the many risks associated with complex supply chains, it’s essential to proactively safeguard your operations. Read on to learn more about how to protect your business in the event of a supply chain crisis.

What Causes a Supply Chain Crisis?

A key supplier or buyer can be debilitated for a variety of reasons, from natural disasters to geopolitical tensions, and these disruptions can ripple throughout the entire supply chain. When even one critical link in the chain falters, the resulting delays, shortages, and cost increases can significantly impact operations, profitability, and customer satisfaction for businesses both upstream and downstream.

Understanding the common causes of supply chain crises is essential for building business resilience. Some of the most disruptive triggers include:

- Cyberattacks: As more critical data is shared via technology across far-reaching global supply chains, cyberattacks can cause severe operational issues.

- Natural disasters: Hurricanes, floods, blizzards, and other natural disasters can disrupt global supply chains by postponing or pausing deliveries, closing ports, and canceling cargo flights.

- Global trade policies and tariffs can increase costs, delay shipments, and create uncertainty in cross-border transactions, causing supply chain chaos.

- Political unrest: Political unrest can cause transportation delays, port closures, labor strikes, or trade restrictions, halting the movement of goods, delaying production, and increasing costs for businesses relying on affected regions.

- Production issues: Global product shortages and unpredictable production issues can clog supply chains, stalling critical processes.

A supply chain crisis, regardless of its cause, can lead to increased operational costs and profit losses. To help mitigate these risks, it’s essential to proactively invest in solutions that will offer protection when your business needs it most, such as supply chain insurance.

Protect Your Business with Supply Chain Insurance

Supply chain insurance is designed to cover losses incurred as a result of an interruption to your supply chain. If your business directly relies on the production ability of a key supplier for its own operations, and there is no alternative supplier available, you are at an increased risk of a debilitating interruption and should consider the following coverage options.

Contingent Business Interruption (CBI) Insurance

CBI insurance provides financial relief when a significant partner, supplier, or manufacturer suffers a property loss significant enough to negatively impact a business’s ability to operate. This type of insurance is generally triggered by physical property damage, such as a fire or flood, that disrupts supplier operations.

Extra Expense Coverage

Extra expense coverage may apply when a policyholder incurs additional expenses due to damage to the property of a supplier. For example, extra expenses may occur due to increased transportation, labor, and logistical costs.

Broader Supply Chain Coverage

Supply chain insurance is designed to provide more comprehensive coverage than CBI insurance. While there is no “standard” supply chain insurance, it can be customized to cover losses caused by a wide range of events, including:

-

- Natural disasters

- Industrial accidents

- Labor issues

- Production process problems

- Political upheaval, war, and civil strife

- Riots or other disruptive civic action

- Public health emergencies

- Regulatory action

- Financial issues

- Road, bridge, and other transportation infrastructure closures

Mitigate Supply Chain Risk With CBIZ

Not sure which kind of supply chain insurance is right for your business? We’re here to help. With the wide range of risks facing today’s supply chains – from geopolitical instability and global trade policies to natural disasters and supplier failures – having the right coverage is essential to protecting your operations and safeguarding your financial stability.

At CBIZ, we specialize in helping businesses identify vulnerabilities, assess coverage gaps, and leverage tailored insurance solutions that align with your risk profile and industry needs. Don’t wait for a disruption to expose weaknesses in your plan. Connect with our team today to proactively safeguard your supply chain and minimize the impact of an unexpected crisis.

© Copyright CBIZ, Inc. All rights reserved. Use of the material contained herein without the express written consent of the firms is prohibited by law. This publication is distributed with the understanding that CBIZ is not rendering legal, accounting or other professional advice. The reader is advised to contact a tax professional prior to taking any action based upon this information. CBIZ assumes no liability whatsoever in connection with the use of this information and assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein. Material contained in this publication is informational and promotional in nature and not intended to be specific financial, tax or consulting advice. Readers are advised to seek professional consultation regarding circumstances affecting their organization.

“CBIZ” is the brand name under which CBIZ CPAs P.C. and CBIZ, Inc. and its subsidiaries, including CBIZ Advisors, LLC, provide professional services. CBIZ CPAs P.C. and CBIZ, Inc. (and its subsidiaries) practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. CBIZ CPAs P.C. is a licensed independent CPA firm that provides attest services to its clients. CBIZ, Inc. and its subsidiary entities provide tax, advisory, and consulting services to their clients. CBIZ, Inc. and its subsidiary entities are not licensed CPA firms and, therefore, cannot provide attest services.