How regional healthcare facilities can align incentives, manage billing arrangements, and ensure FMV in rural healthcare delivery.

It is often said that healthcare is local. But for millions of Americans in rural communities, keeping healthcare close to home is becoming increasingly difficult. Unlike their urban counterparts, rural residents face a variety of barriers that limit access to timely, high-quality care. Chief among them are geographic isolation and a shortage of healthcare professionals. These challenges have contributed to a rise in maternal care, pharmacy, food, and other healthcare deserts, exacerbating health disparities for residents of rural America.

For years, rural hospitals have partnered with regional facilities and provider groups to expand access by bringing specialty services to local communities through outreach agreements. These arrangements bring specialized services to underserved communities. This article outlines key considerations and best practices for structuring such arrangements in a compliant manner and aligning incentives.

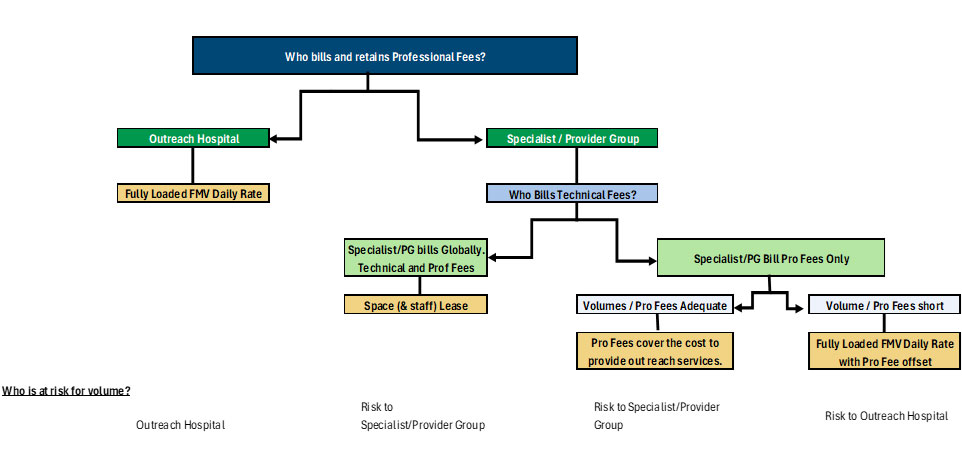

Who Bills and Retains Professional Fees?

The first and most critical question in structuring an outreach arrangement is determining which party will bill for and retain the clinicians’ professional fees. While each model has advantages and disadvantages the decision should not hinder efforts to bring essential services to underserved communities. Regardless of which party retains professional fees, all compensation arrangements must reflect Fair Market Value (FMV).

Scenario 1: Outreach Hospital Retains Professional Fees

In our experience, the most common and often most straightforward model allows the outreach hospital to retain the professional fees. This approach can simplify some of the nuances and complexities related to patient scheduling systems, ownership of medical records, and claims management.

When the outreach sire retains professional fees, the facility assumes the risk associated with patient volumes. As a result, identifying patient demand and need is a critical first step in defining the scope and frequency of specialist services.

The most utilized method for compensating clinicians for their services is a fully loaded FMV daily rate. The fully loaded daily rate recognizes that the party providing the specialist’s services is responsible for covering the full cost of employment, including employer-side payroll taxes and benefits (e.g., retirement, health, dental) and malpractice premiums.

Scenario 2: Specialist / Provider Group Retains Professional Fees

While not as common, we do see arrangements where the specialist’s provider retains the professional fees. In such models, it is also necessary to determine who will be responsible for billing and retaining the technical fees.

When the provider of the specialist bills globally (retaining both professional and technical fees), the group assumes the risk for patient volumes. In this case, the outreach facility generally pays an FMV lease rate for space and staffing. When the provider group retains professional fees, and the outreach site retains technical fees, consideration should be given to whether the projected professional fees are adequate to cover the fully loaded costs of the specialist’s services. Suppose professional fee revenue is projected to be short of the fully loaded cost to provide the specialist’s services. In that case, compensation is typically structured as a fully loaded FMV daily rate offset by and trued up to actual professional fees. Under this structure, the outreach facility is at risk for patient volumes and payer mix.

The accompanying chart is here to help guide you through the process.

Failing to apply appropriate FMV methodologies to the payments being made, and/or failing to match the payments being made to the services being provided, has the potential to be looked upon as payments made to induce referrals.

Have Questions about Rural Healthcare Partnerships?

If you need help or have any questions on structuring FMV-compliant arrangements, please contact a CBIZ professional today for expert guidance and support.

© Copyright CBIZ, Inc. All rights reserved. Use of the material contained herein without the express written consent of the firms is prohibited by law. This publication is distributed with the understanding that CBIZ is not rendering legal, accounting or other professional advice. The reader is advised to contact a tax professional prior to taking any action based upon this information. CBIZ assumes no liability whatsoever in connection with the use of this information and assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein. Material contained in this publication is informational and promotional in nature and not intended to be specific financial, tax or consulting advice. Readers are advised to seek professional consultation regarding circumstances affecting their organization.

“CBIZ” is the brand name under which CBIZ CPAs P.C. and CBIZ, Inc. and its subsidiaries, including CBIZ Advisors, LLC, provide professional services. CBIZ CPAs P.C. and CBIZ, Inc. (and its subsidiaries) practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. CBIZ CPAs P.C. is a licensed independent CPA firm that provides attest services to its clients. CBIZ, Inc. and its subsidiary entities provide tax, advisory, and consulting services to their clients. CBIZ, Inc. and its subsidiary entities are not licensed CPA firms and, therefore, cannot provide attest services.