For contractors, the schedule of work-in-progress, or WIP, is essential financial information as it contains vital information about each job, including total contract amount, expected gross margins, revenue earned from inception as well as year to date, and percentage complete. The WIP also contains indicators of the financial health of a construction company. Additionally, the WIP is a critical input to financial forecasts and budgets.

Information gathered from the WIP report by business appraisers when valuing a construction company also provides important data in the assessment of critical key inputs in the due diligence process. Specifically, backlog is the critical piece of information that appraisers look for on the WIP report. Backlog, defined as total contract value less total revenue earned on contracts, is often on WIP reports directly. However, more commonly, it must be calculated from the information provided in the WIP report. Backlog provides a sense of the bottom (or floor) pertaining to both the (i) revenue and (ii) gross profit that is expected to be earned in the period(s) immediately following the current financial statement/WIP report.

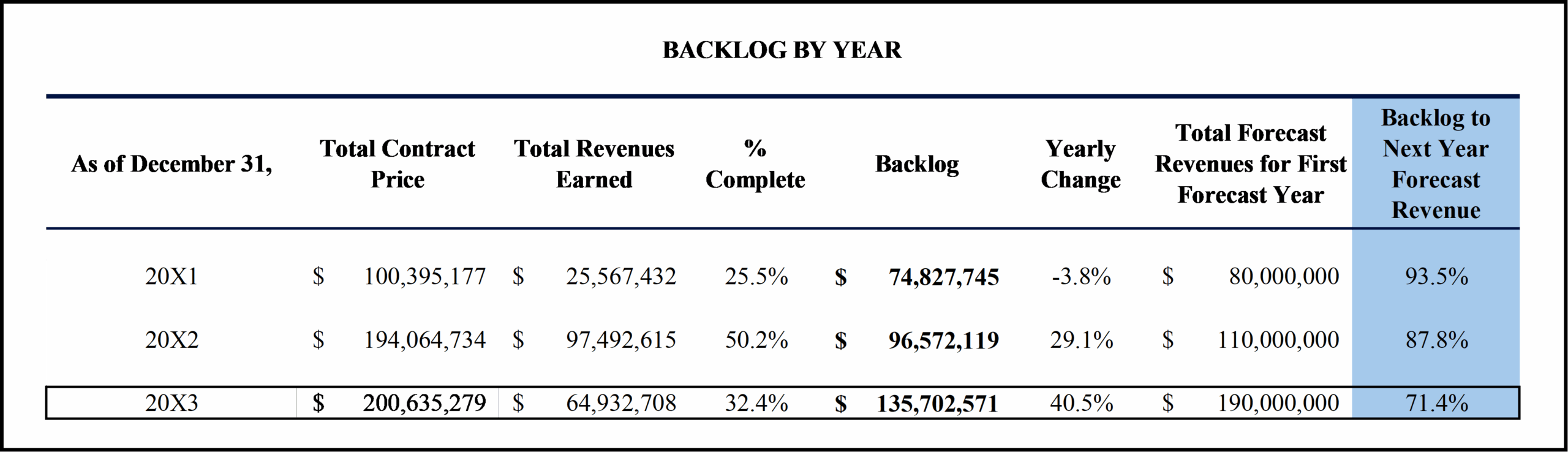

An important formula, the backlog to forecast revenue, is a critical ratio to be analyzed. By comparing the backlog to management’s expectation of next period(s) revenue, one can analyze an indicator of perceived risk inherent in such revenue projections. Consider this example:1

Backlog ($10,000,000) / Next year forecast revenue ($15,000,000) = 66.6%

The backlog to next year revenue ratio in this example indicates that in the next year, 66% of the forecast revenue is supported by signed contracted projects. In this example, if the company has forecasted that it will achieve $15.0 million in revenues in the next year, more contracts will need to be signed to achieve the forecast revenue.

One way that appraisers assess the risk associated with management’s budgets or forecasts is to utilize this ratio. A higher ratio could indicate a higher level of certainty regarding forecast risk, which gives the appraiser confidence that forecast revenues can be achieved, which could potentially increase the fair market value of a company. Additionally, reviewing this ratio on a historical basis can give appraisers an indication of the trend of realized revenues in historical years based on the previous year’s level of backlog. In the simple table below, the backlog to next year revenue ratio has decreased over time.

In this example, while Total Contract Price and Backlog figures have increased each year, the Backlog to Next Year Forecast Revenue ratio has decreased, which could indicate that the contractor is trending towards making more aggressive forecast growth assumptions.

Another important distinction to recognize is that if the backlog-to-next-year ratio is changing, this also could indicate that the project duration is changing. Longer project duration times could mean a contractor is taking on more complex or larger projects, or it could indicate problems with adhering to project timelines. If contracts are extending into the second forecast period (after the Backlog schedule point in time), the risk in achieving forecasts two years out is seen to be lower. Further discussions with management would be required to know the details of project timelines, job durations and size of projects.

Other information gathered from the WIP includes the gross profit on jobs, the percentage completion on jobs, and the backlog as a percentage of total backlog. Low gross profit margins, jobs that are nearly complete with no new projects being signed, or high backlog concentration risk can also give appraisers concern.

The valuation of a company primarily considers two factors: (1) a company’s future cash flows, and (2) the risk associated with achieving those cash flows. If future cash flows are “guaranteed” by the backlog, that may indicate a higher indication of value. Construction can be a highly cyclical and volatile industry at times, and this can create more uncertainty in a valuation. While signed contracts are no guarantee of future profitable cash flows for a contractor, a backlog analysis can provide helpful insight as to the reasonableness of management’s projections and produce a more substantiated valuation.

- This example assumes that on average, this contractor completes jobs in one year. If typical project duration is longer than one year, the backlog to next year revenue ratio will likely be lower, and the ratio must be analyzed carefully.

© Copyright CBIZ, Inc. All rights reserved. Use of the material contained herein without the express written consent of the firms is prohibited by law. This publication is distributed with the understanding that CBIZ is not rendering legal, accounting or other professional advice. The reader is advised to contact a tax professional prior to taking any action based upon this information. CBIZ assumes no liability whatsoever in connection with the use of this information and assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein. Material contained in this publication is informational and promotional in nature and not intended to be specific financial, tax or consulting advice. Readers are advised to seek professional consultation regarding circumstances affecting their organization.

“CBIZ” is the brand name under which CBIZ CPAs P.C. and CBIZ, Inc. and its subsidiaries, including CBIZ Advisors, LLC, provide professional services. CBIZ CPAs P.C. and CBIZ, Inc. (and its subsidiaries) practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. CBIZ CPAs P.C. is a licensed independent CPA firm that provides attest services to its clients. CBIZ, Inc. and its subsidiary entities provide tax, advisory, and consulting services to their clients. CBIZ, Inc. and its subsidiary entities are not licensed CPA firms and, therefore, cannot provide attest services.