The Main Street Index (MSI) takes the pulse of and gauges the outlook for small and mid-sized businesses (SMBs) on a range of timely topics, including business confidence, top concerns, workforce issues, cash flow, price changes, artificial intelligence and more. In this report, we share the key findings, offer expert insights and provide actionable resources for your organization to leverage.

Workforce Challenges

The CBIZ Main Street Index found that companies are facing growing staffing challenges, as rising business costs and economic conditions are prompting potential layoffs. Fifty-one percent of SMB owners surveyed say they are evaluating or changing current staff levels and outsourced partners to prepare for a potential economic downturn. Additionally, 62% of businesses report they are able to utilize their staff to its full capacity, down 7% from June.

“We are at an inflection point in the economy, where uncertainty is high, and labor data trends are inconsistent. Many businesses, especially SMBs, are reevaluating their staffing and operational strategies in response to rising costs and economic shifts. The Federal Reserve has embarked on a cutting cycle, but the impact of monetary policy comes with a lag. We’re seeing significant impacts of the sustained restrictive policy across rate-sensitive sectors, sluggish M&A activity and dearth of IPOs. Slower financial activity may have broader implications for Main Street, including workforce utilization and the potential for tougher times ahead.”

– Anna Rathbun, Chief Investment Officer, CBIZ Investment Advisory Services

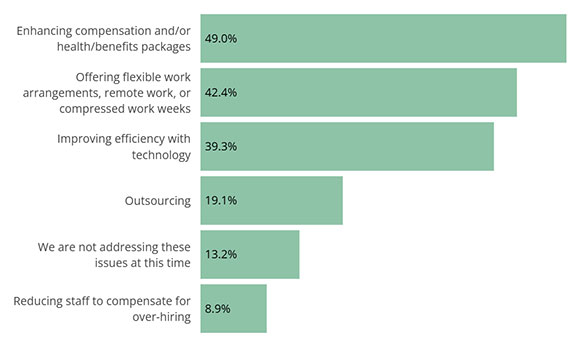

Tactics to Address Workforce Issues

Faced with workforce issues, SMBs are using three main tactics: enhanced compensation and/or benefits, offering flexible work arrangements and improving efficiency with technology. While the top tactics remain the same as the Summer Index, there was a 4.1% increase in benefits/comp enhancements.

Get strategies to optimize your employee experience with a total rewards approach, including compensation, employee benefits, and growth and development opportunities. Download your free copy of the “Annual Employee Experience Guide.”

TRENDS LEADING INTO 2025

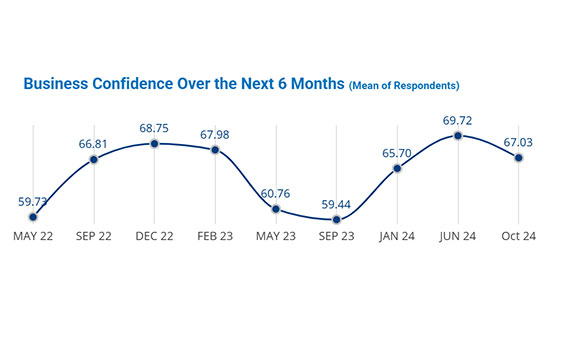

Small and mid-sized businesses continue to have a high level of business confidence.

The Index’s Business Confidence Study’s weighted average is 67.03. While down 2.69 points since Summer, this is still up almost 8 points since last Fall. Additionally, small to mid-sized businesses continue to expect increased revenue over the next four months. This rise in revenue expectations is the highest reported since before Q1 2023.

Impact of Insurance Cost Increases

SMBs are increasingly impacted by insurance costs, with health insurance impact up by 14.2% and property insurance impact up by 8.2% since summer.

Percentage of respondents reporting insurance costs having a moderate to significant impact on their organization

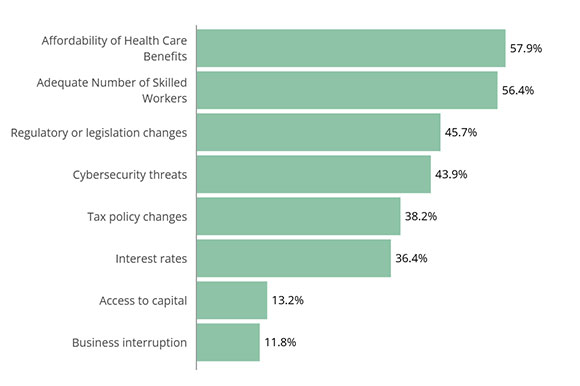

Top Concerns

Affordability took over as the top concern, with having an adequate number of skilled workers at number two. Regulatory or legislation changes made it’s debut as a top concern, and cybersecurity threat concerns increased 9.4% from Summer.

Looking for strategies to protect your business from cyberthreats? View the Cybersecurity Special Edition of our newsletter.

Cash Flow & Borrowing Costs

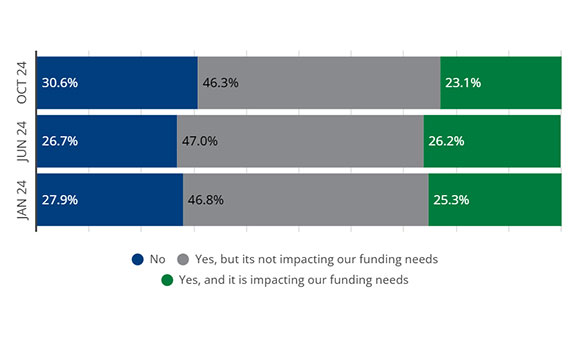

Organizations Experienced Higher Borrowing Costs

Respondents were asked if they have experienced higher borrowing costs. The following graph shows the impact that higher borrowing costs are having on the funding needs of organizations.

Preparation for Potential Downturn

Respondents were asked to select any adjustments that their business has made or is planning to make to minimize their vulnerability to an economic downturn. While the top three strategies remain the same as Summer, workforce optimization took over as number one.

Adjustments For The Economy

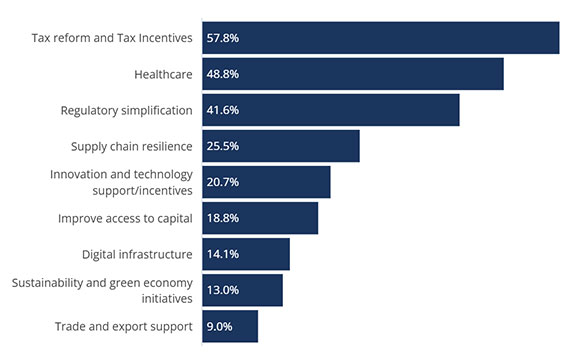

Top Economic Areas Where Policy Makers Should Focus

Respondents were asked to select the top economic areas where policymakers should focus in 2025.

Price Changes

Business leaders were asked: What price changes have you made over the last 3 months due to inflation? The following graph represents the percentage of pricing changes over time.

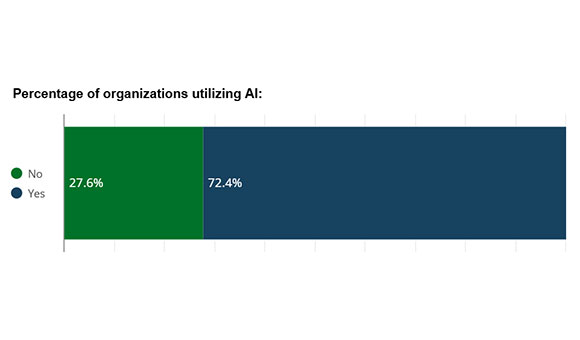

Artificial Intelliagence (AI)

Importance of AI Utilization to Stay Competitive

Respondents were asked how important is it to adopt AI in their business to stay competitive in their industry

AI Risk Management Program Implementation

Respondents were asked if they have an AI risk management program in place to understand and manage AI-related risks.

“It’s important for businesses to recognize AI’s significant risks, including liability for failure to comply with emerging laws and regulations. For example, New York City’s AI Bias law and Colorado’s Consumer Protections for Interaction with Artificial Intelligence require that companies put an AI Governance program in place that includes a thorough review of third-party provided AI applications before use. If you have a program, ensure that it aligns with prevailing best practices (e.g., NIST AI Risk Management Framework, ISO 42001), if you don’t, understand that you will be held responsible for any biased/discriminatory/inaccurate decisions made by AI-enabled processes.”

– John Verry, Managing Director, CBIZ Pivot Point Security