Employers sponsoring HSA compatible high-deductible health plans have been anxiously awaiting a determination about whether a plan will be able to continue to cover remote services prior to satisfaction of the HSA minimum statutory deductible. The answer to that question is at this point, no. On December 23, 2024, The American Relief Act of 2025, was signed by President Biden, and did not include an extension. Therefore, the relief allowing first dollar coverage of telehealth and other remote services expires for plan years beginning in 2025.

Employers with calendar year plans, who offer HSA compatible high deductible health plans, will want to think through a wait and see approach or, to ensure HSA-eligibility, the fair market value of telehealth services will need to be charged until the minimum statutory deductible has been satisfied. If fair market value cannot be determined another option might be to allow no telehealth or other remote services prior to meeting the HSA statutory deductible. If the telehealth or remote services qualify as preventive, of course the services can be provided at low or no cost. A non-calendar year plan may have some time before a decision needs to be made.

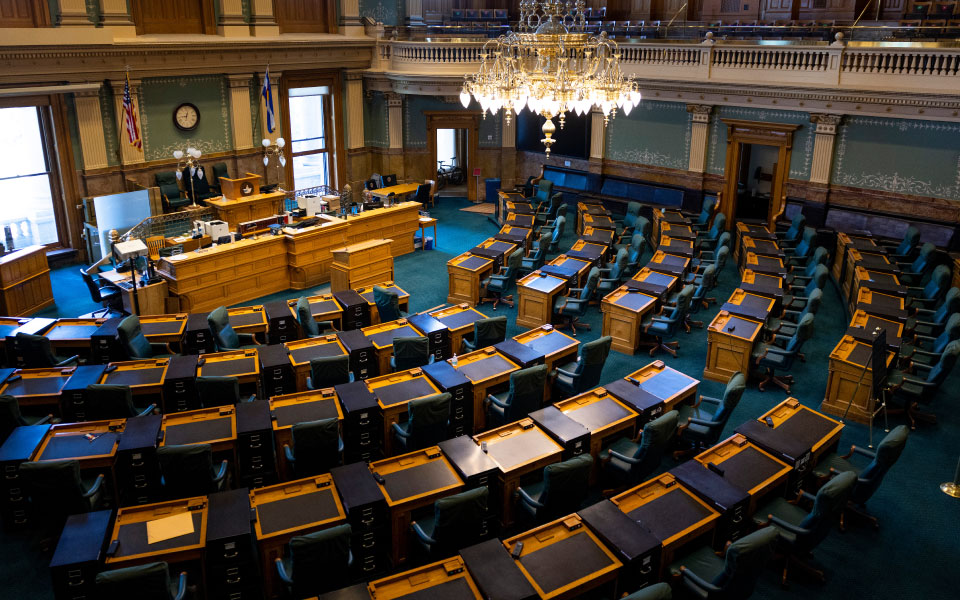

There is strong bipartisan support for this issue, and there is optimism that when Congress returns in 2025, they will address this issue and possibly could make an extension retroactive to January 1, 2025. We do not know at this point how this will play out; employers will want to keep an eye on future action that either reinstates the permissive standard temporarily or makes it permanent.

The information contained in this Benefit Beat is not intended to be legal, accounting, or other professional advice, nor are these comments directed to specific situations. This information is provided as general guidance and may be affected by changes in law or regulation. This information is not intended to replace or substitute for accounting or other professional advice. You must consult your own attorney or tax advisor for assistance in specific situations. This information is provided as-is, with no warranties of any kind. CBIZ shall not be liable for any damages whatsoever in connection with its use and assumes no obligation to inform the reader of any changes in laws or other factors that could affect the information contained herein.

© Copyright CBIZ, Inc. All rights reserved. Use of the material contained herein without the express written consent of the firms is prohibited by law. This publication is distributed with the understanding that CBIZ is not rendering legal, accounting or other professional advice. The reader is advised to contact a tax professional prior to taking any action based upon this information. CBIZ assumes no liability whatsoever in connection with the use of this information and assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein. Material contained in this publication is informational and promotional in nature and not intended to be specific financial, tax or consulting advice. Readers are advised to seek professional consultation regarding circumstances affecting their organization.

“CBIZ” is the brand name under which CBIZ CPAs P.C. and CBIZ, Inc. and its subsidiaries, including CBIZ Advisors, LLC, provide professional services. CBIZ CPAs P.C. and CBIZ, Inc. (and its subsidiaries) practice as an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations, and professional standards. CBIZ CPAs P.C. is a licensed independent CPA firm that provides attest services to its clients. CBIZ, Inc. and its subsidiary entities provide tax, advisory, and consulting services to their clients. CBIZ, Inc. and its subsidiary entities are not licensed CPA firms and, therefore, cannot provide attest services.